Grow Your Savings For Retirement

my65+ Helps You Build A Better Financial Future

my65+ is a digital retirement savings plan designed for union members and their spouses

We believe that everyone deserves to retire with dignity. This plan provides an easy way to plan, save, and grow your money for retirement.

Feel Confident About Your Financial Future

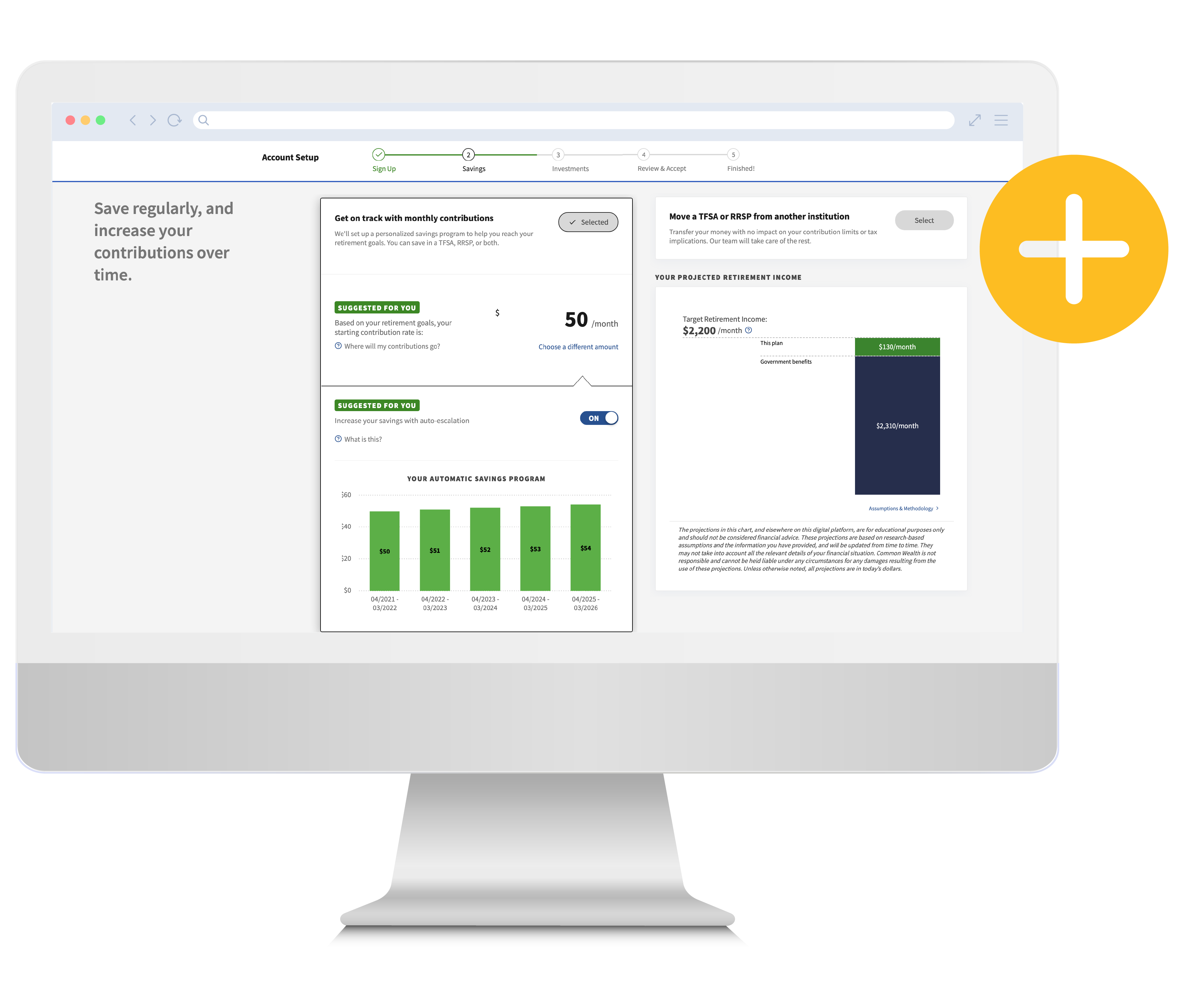

An easy way to save your money

01Automatic monthly saving helps you stay on track to reach your retirement goals.

A personalized way to grow your money

02We automatically match you to the most appropriate investment to grow your money, based on your age and retirement goals.

Full access to track your progress

03Your online account gives you full access to check your balance and manage your money.

Low Fees Mean More Money In Your Pocket

My65+ fees are nearly half of what the average Canadian pays to invest, which means your money grows bigger than with traditional RRSPs.

1.10% annualized; fees are automatically withdrawn from your account each month. **All fees are approximate lifetime estimations. HST applies.

Mariana

Mariana

Personal Support Worker

Saves $50/month for 45 years

my65+ savings potential compared

to an average RRSP

Maximize Your Government Benefits

my65+ will help you save thousands of dollars in taxes and gain thousands of dollars in government pension benefits when you retire.

Typical

RRSP

You risk losing 50 cents of every dollar in Guaranteed Income Supplement (GIS)

You get 100% of the Guaranteed Income Supplement (GIS) you qualify for

Find out how much you can save for retirement

Create your online account to find out how much you should save for retirement and what you can expect from government benefits – it only takes a few minutes.