How much can I contribute to my RRSP?

With the RRSP deadline approaching, you may be wondering how much you can contribute to your my65+ plan. General contribution limits for RRSPs, TFSAs, and DPSPs are set by the government and can be found here.

You can find out your contribution room online through the CRA’s My Account service. If you have not yet created an account, you can contact the Canada Revenue Agency at 1-800-267-6999.

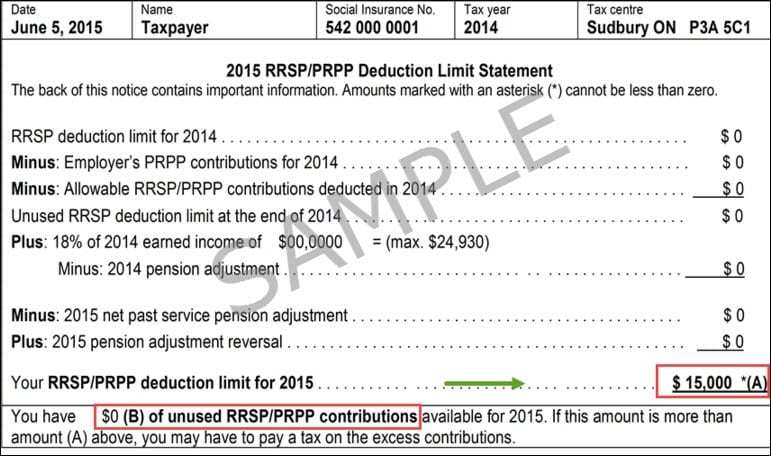

You can also check your last notice of assessment or reassessment notice from the CRA to find your RRSP deduction limit.

To ensure your contribution is processed and meets the RRSP deadline, contributions to the my65+ plan must be made by Wednesday, February 28th, 2024, at 11:59 pm EST.

Maximize your savings

You also have a TFSA in your my65+ plan, which means you can contribute another $7,000 to your retirement plan in 2024. Many people don’t think to use TFSAs for retirement, but every dollar of retirement income you withdraw from a TFSA is 100% tax-free.

And if it looks like you might be getting a tax refund in the spring, you can consider putting it to work in your my65+ plan.

Need Help?

Our retirement specialists are always happy to answer questions about contributing to your my65+ plan. You can contact us anytime.